Founder – this is how you will invest the fundraising money correctly.

Many founders are confused about how to invest the fundraising money. In Seed funding, an average startup meets for the first time in its life an amount of money equal to 1-4 million dollars, and in Round A the startup meets several million dollars. The feeling is good, the smile returns to the face, but how do you keep the money, and how should it be invested in a solid and safe way?

Exchange rate exposure

Most of the startups active in Israel operate with exposure to a change in the foreign currency exchange rate, depending on which countries the customers, suppliers and employees are active in. As a result, there is sensitivity to the exchange rate. In most cases the exposure will be to US dollars, and then we will have to deal with a number of questions about the amount we would like to protect, as well as the instrument with which we would like to protect.

To simplify things, we will present a numerical example:

A young startup raised 1.5 million dollars in SEED, with 70% of its expenses being in shekels (such as salary expenses, 30%, and the remaining 30% dollar expenses (hosting expenses, licenses and marketing, etc.). This startup would prefer to receive most of the fundraising money In shekels, most of the expenses are in shekels, in order to create a parallel between the currency of the recruitment and the currency of its expenses.

In a framed article, most VCs (venture capital funds) in Israel raise in dollar currency, therefore the investment currency in most cases will be dollars, when the exchange rate fluctuations can reach 10% per year, and may erode the investment funds.

A startup whose fundraising funds were supposed to be enough for him for two years until the next round, if he does not protect himself, may find himself in a situation where he has lost 2-3 months of his life, which means that he will not have enough time to complete his goals. And he will reach the next recruitment round at a lower value, and in the worst case – he won't even be able to recruit at all.

How to protect the money?

First of all, a flow must be prepared according to the currency of the company until the next round, for example in the flow we will indicate the salary of the employees in shekels, online marketing expenses in USD, so that the result will eventually calculate what is the main operating currency of the company, and which other currencies have exposure.

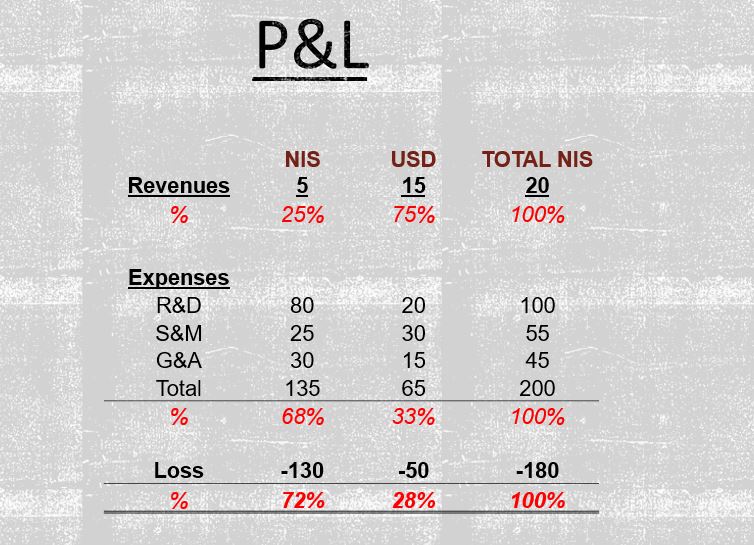

An example of RAV (cash) according to currency exposure:

It can be seen from the example that 68% of the projected expenses are in NIS and 33% of the expenses are in dollars, so currency exposure must be considered in the income section, as they increase or decrease the exposure to the currency.

In the above example, in order to avoid exposure to the shekel, we would keep 28% of the fundraising funds in dollars and 72% we would convert to shekels, and deposit in a shekel deposit (note that the fundraising funds were received in USD).

* In the future cash flow both in capital expenditures, and in liabilities that are not reflected in the reports.

How will we invest the investment money?

After we have calculated the future exposure to each of the currencies we will want to adjust the investment funds to our flow. If we have come to the conclusion that 68% of the future cash flow is shekels, then we will make sure to proportionally convert 68% of the investment money we received in dollars, into shekels. And we will deposit the shekels in a shekel deposit for the company's current use.

In this article, we do not deal with the issue of hedging the exchange rate, for the reason that if I have the parallel between the shekels and the dollars in the bank, for my future flow, then I am indifferent to the fluctuations. When I have future exposure to the exchange rate, only then will we use common protection tools such as forward transactions in which the exchange rate is determined in advance, and option purchase transactions that grant the right to sell at a stated rate for a premium paid in advance