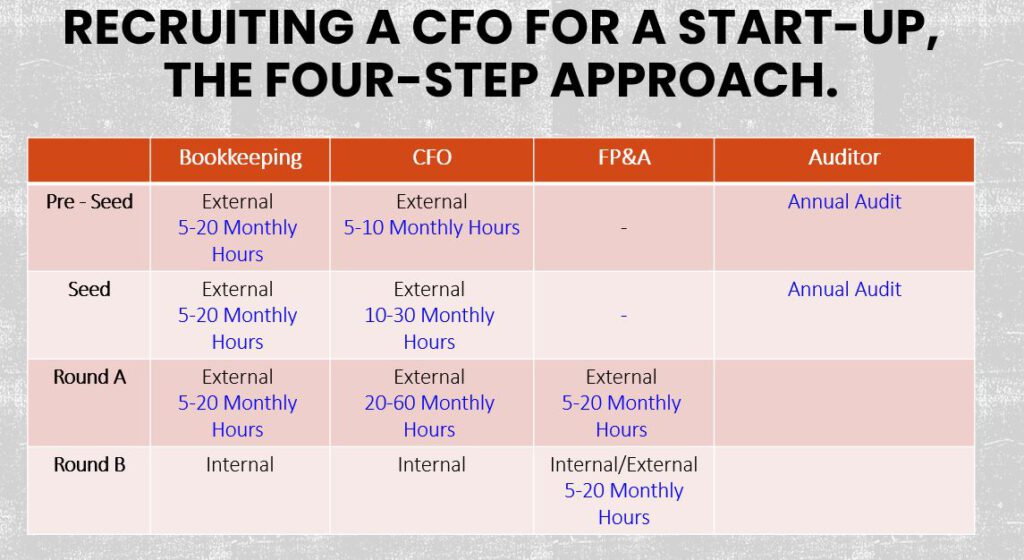

Recruiting a CFO for a start-up, the four-step approach

A financial manager is very important to the success of the company in general, and the startup in particular. A skilled CFO will build necessary infrastructures that will support the company's growth and will assist in a recruitment strategy and in building a reporting system for management and investors, in managing the necessary KPIs for management to make decisions.

According to startup-gowhere, about 37% of startups fail because they didn't manage their cash flow correctly, in addition about 19% failed to build correct pricing for customers. These are issues that a good CFO will help the company succeed in, and increase the chance of success

Step 1 – Pre-Seed

The first step in the life of a startup is pre-seed fundraising. This is the stage where a small investment of several hundred thousand dollars is raised from family and friends or from Angels. The founders establish a company and sign a founders agreement. At this stage there is still no income for the company, and there are no employees with the exception of the founders who are employed at a reduced salary.

At this stage, an external accountant is needed for the company on a part-time basis, since the volume of work does not justify hiring an internal accountant. It is also necessary to open files for income tax, VAT (for the purpose of recognition of input VAT) and national insurance (the company employs employees, so registration is necessary). The registration can be done by an external accountant or the representative.

Regarding CFO, the need can vary from company to company, but from 20 years of experience as a CFO in high-tech companies, the need is usually little between 0-10 hours a month, in which there is a need to assist the CEO from a financial point of view, preparing reports and answering current problems.

Step 2 – Seed

At this stage the company is recruiting employees and building the administrative avenue. This is a critical stage in which the CFO has great importance for the success of the company. At this stage, the accounting is mostly still external, although the volume of work is increasing. Yes, at this stage there is no need for an accountant or FP&A as a skilled CFO can provide a single answer to all financial needs in the company.

The CFO at this stage will often help build a reporting infrastructure, deal with the flow, build a budget for the activity, and measure the company's KPI.

Stage 3 – Round A

This is the phase of growth and entry into new markets. At this stage the company already employs employees and has sales of millions of dollars.

At this stage, the financial work is more, in terms of accounting, there are companies that will hire internal accounting, there are companies that will continue to use external accounting.

In terms of CFO, the demand for his services is increasing, here too there are companies that will hire an internal CFO and there are companies that will hire an external CFO. At this stage, the CFO is very important in terms of tax planning, help with recruitment and investor relations. Yes, the CFO will be involved in managing negotiations with suppliers, and will even respond to simple legal problems (contracts, labor laws) so a good CFO will need a variety of skills to help him in his role

Hiring an internal CFO has the advantages of availability, and knowing the company in depth, on the other hand, the cost of hiring him is very high, compared to an external CFO whose cost is more flexible according to the needs of the company, it is usually possible to reach the employment model of a retainer so that the expense turns from a variable expense to a fixed expense.