How to Write a Business Plan for a SaaS Company

A SaaS company is one that provides software as a service (Software as a Service), where customers can, after a short registration, access and use the software through a web browser and an internet connection (unlike the older generation who remember downloading, installing software, or even buying software CDs like Windows). Examples of SaaS companies include Monday.com, WIX, Salesforce, and others.

A business plan is a document that tells the story of the venture. Through the plan, we describe how, with an investment or a loan, the venture will go from point A to point B along a timeline.

It is recommended to first read the article on writing a business plan to understand and get familiar with the basics of business plan writing, as well as the article about KPIs.

The Reports to Include in a SaaS Business Plan

When preparing a business plan, we include the following reports that outline—in numbers—how we plan to execute the venture using the investment/SAFE funds:

Profit and Loss Statement (P&L) – A report showing the venture’s revenues and expenses over a period of 18 or 24 months (sometimes even 5 years or more, for long-term ventures like drug development, real estate, medical devices, etc.). The P&L statement shows total income, expenses, and the operational profit or loss of the business. We’ll detail the revenue and expense components further below.

Cash Flow Report – The most important report in the plan, where we present all cash inflows and outflows, simulating the company’s bank account. Unlike the P&L, which spreads costs over time (e.g., depreciation), the cash flow report shows the full cash amount at the time of payment. For example, if you purchase a computer for 4,000 NIS, the P&L will show only part of the cost as depreciation (e.g., 1,333 NIS), while the cash flow report will show the full cost and ignore depreciation.

Revenues

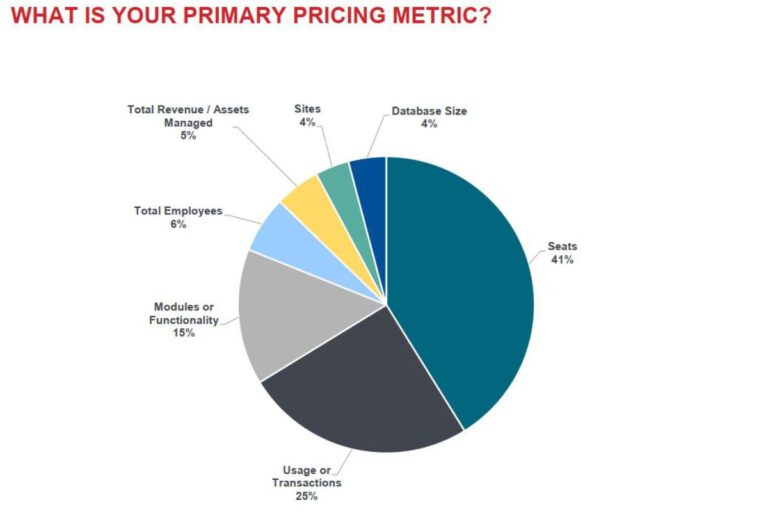

Before writing this section, you must define the revenue model of your SaaS company, as it determines how to calculate revenues. In the image below (not provided), you can see the common pricing models used in SaaS companies. The percentages are based on a survey of ~350 SaaS companies worldwide. It shows that the most common method is by “seats” or number of users (45%), followed by usage-based pricing or number of transactions (25%).

Sales – It’s recommended to break down the sales section into subcategories, such as subscription types (Basic, Standard, Premium) or customer segments (Small, SMB, Enterprise). Each subscription type has a different CAC (Customer Acquisition Cost), revenue, and sometimes LTV (Lifetime Value). Therefore, to make the plan accurate, you should go one level deeper than just total revenue and analyze the income type based on your selected categories.

If you intend to sell in multiple geographic regions, it’s best to reflect this in the revenue sheet, dividing it into key regions like US, EU, and Asia. This provides investors with information on where your main revenue sources are and where you plan to expand.

Sometimes, sales are a result of your marketing and sales budget. Therefore, the spreadsheets may be linked—based on your marketing budget and the CAC for each customer type, the number of acquired customers will be calculated accordingly.

Expenses

R&D Expenses – In this section, we include employee salaries. If we employ developers in Israel/Ukraine/USA, we must consider the employer’s total cost, not just gross salary (employer cost includes employer’s National Insurance payments, pension, education fund, vacation/recuperation payments). We also include the cost of subcontractors and UX/UI design.

Grants – If the venture plans to receive government grants for development expenses, these should be added to development expenses as a negative amount (reducing the expense), and not recorded as income.

Sales and Marketing Expenses – This section should include salary expenses, offline and online advertising costs, business development salaries, travel abroad expenses, and participation in conferences. It is important to note that if we plan to sell through a foreign subsidiary, the plan should be prepared on a consolidated basis, so that expenses planned for the subsidiary are also included.

General and Administrative Expenses – Include management salaries, office rent, communication expenses, employee welfare (refreshments, training), professional consulting including legal expenses and CFO costs. Investors usually prefer to see these expenses kept as modest as possible. So, if the CEO is also involved in development, his/her salary should be split across several categories.

Cash Flow

Cash flow is one of the most important reports in a business plan, and the following aspects should be considered when preparing it:

- Supplier credit – Take into account an average credit term of net + 30 days.

- Customer credit – Depends on the customer type. For institutional clients like hospitals and HMOs, use an average of net + 90 days.

- Fixed assets – The cost of acquiring fixed assets should be included in the cash flow. Depreciation should be included in the profit and loss report.

- Capitalization of development expenses, patent registration – These should be included in the cash flow according to accounting standards. Depreciation and amortization should be included in the depreciation and amortization expense section.

- Investment – The investment should be included in the cash flow, and it should be analyzed how many months the investment will cover before the venture needs to raise follow-up funding. Typically, reports will cover 18 or 24 months.